With petrol prices hovering near Rs 120, looking for ways to save on that spending has become essential. The best way to do it is to use a fuel credit card. Before choosing a fuel credit card, it is best to determine which fuel pump will be convenient for you – IOCL, HPCL, or BPCL. It is because all fuel credit cards are specific to a brand. In this article, we review the IndianOil Citibank credit card.

Table of Contents

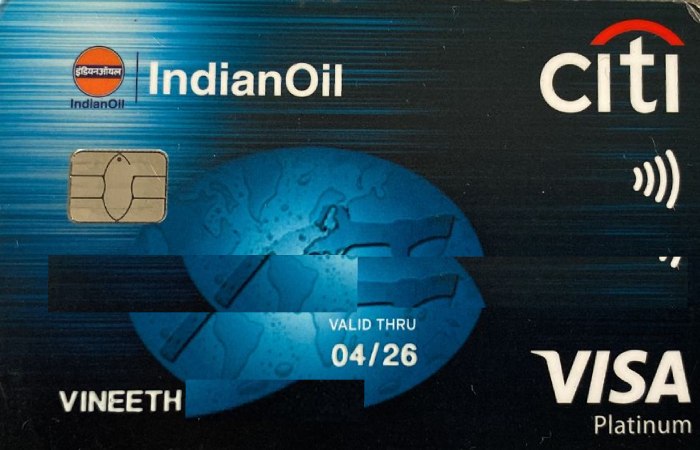

Citi Indianoil Credit Card

Citi IndianOil Credit Card is considered one of India’s finest fuel credit cards. This credit card gives you a host of offers on fuel purchases. This card is specially designed for people who depend on their vehicles for their daily commute. The Citi IndianOil Credit Card offers many suggestions and reward points on fuel, grocery, and supermarket spending, making this card a great option for everyday purchases. You have to pay an annual fee of Rs 1000 on this card. However, the annual fee is also waived with certain conditions.

Features and Benefits of Citi Indianoil Credit Card

- Welcome Benefit: 250 Turbo Points if you make a transaction within 30 days from the date of issuance of the Citi IndianOil Credit Card.

- Annual fee waiver: If you spend extra than Rs.30,000 in a year using the Citi IndianOil Credit Card, your card’s annual fee is waived.

- Reward Points: Mentioned below are the rewards you can earn using the Indian Oil Citi Credit Card.

- On this card, you get 4 Turbo Points for every Rs 150 spent at IndianOil retail outlets nationwide.

- Make 2 Turbo Points for every Rs 150 expended on groceries and supermarkets.

- 1 Turbo Point is awarded for all other Rs.150 spent.

- The Reward Points you earn never expire.

- Fuel Surcharge Waiver: Avail a 1% fuel surcharge waiver on fuel purchases at any IndianOil station in India using this card.

- EMI Benefit: You can convert purchases above Rs.2,500 with this card into EMIs and pay in easy installments.

- Dining Offers: You can avail up to 20% off at over 2000 partner restaurants across India.

- Instant Loan: You can avail instant loan on your Citi IndianOil Credit Card.

How Do I Apply For Indianoil Citibank Platinum Credit Card?

- You can visit the official Citibank website and click “Credit Cards.”

- Under the ‘Fuel’ category, click ‘Indian Oil Card.’

- Fill in your details, including your PAN number and income, as required in the application form.

- Read and agree to the Card Terms and Conditions, then click Submit.

- Once you submit the request form, the bank will verify your eligibility.

- A Citibank representative will contact you if you qualify regarding the following process.

- You can also check the status of your credit card application online. Please enter your application reference number and mobile phone number to check the status of your application.

- The order status is updated after 24 hours from the time of the request.

What documents do I require?

- identity proof (Aadhaar card, PAN card, driving license, voting card)

- address proof (includes documents like passport, electricity bill, gas bill)

- passport-size colored photographs

- attach is the declaration form duly sign

frequently asked questions (FAQs)

Why should I consider the IndianOil Citibank Platinum Credit Card?

IndiaOil Citibank credit card offers various benefits like redeeming turbo points on fuel, groceries, online shopping, and more. It will help you to save a lot of money on your daily expenses.

How can I know my current reward points at the time of purchase?

You can check your current reward points by SMSing 52484 (SMS REWARDS XXXX – where XXXX is the last four digits of your card) from your registered mobile number.

What Is The Minimum Reward Points To Redeem?

You will need 250 reward points before you can redeem them in transactions.

When Do My Turbo Points Expire?

There is no expiry date for Turbo Points. You can use them right away or save them for later.

Can I Transfer My Reward Points To Another Citibank Platinum Credit Card Holder?

No, you are not allow to transfer Reward Points to another cardholder.